2022 tax refund calculator canada

To 6 pm ET Monday to Friday. Free easy and accurate Quebec tax return estimate.

Tenant Payment Ledger Remaining Balance Rent Due Calculator 25 Properties Rental Property Management Rental Property Rental Income

Rates are up to date as of June 22 2021.

. ET for French during tax season from February 22 to May 2 2022. It does not include every available tax credit. The Tax Shield is not included in the calculation.

But there might be certain cases where you can claim it as a tax refund. Facebook Twitter Linkedin Instagram Youtube. Based on Ontarios land transfer tax rates this refund will cover the full tax for homes up to 368000.

2021 2022 tax brackets and most tax credits have been verified to Canada Revenue Agency and provincial factors. April 20 2021 at 934 pm. The IRS issues more than 9 out of 10 refunds in less than 21 days.

History of the Property Transfer Tax. If youve ever worked Down Under you probably paid tax and are due an Australian tax refund. This calculator is intended to be used for planning purposes.

After-tax income is your total income net of federal tax provincial tax and payroll tax. The income tax department has recently claimed to have. The average direct deposit tax refund was close to 3000 last tax season and with tax season well underway its no surprise that the most common tax season-related question were now hearing is.

TurboTax free Canada income tax calculator for 2021 quickly estimates your federal and provincial taxes. The Taxback team made it very easy and uncomplicated for me to access my tax back. The IRS strongly encourages most couples to file joint tax returns by extending several tax breaks to those who file together.

Calculate your total income taxes with TurboTax income tax calculator. Calculate your 2021 estimated personal income taxes in Quebec with the TurboTax income tax calculator. ET for French during tax season from February 22 to May 2 2022.

When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up. As per the Income Tax Act a person is required to file hisher return in the relevant assessment year by July 31 unless the deadline is extended to claim the tax refund. Ontario Land Transfer Tax Calculator.

Welcome to our Australian Tax Refund calculator. The maximum tax-break you can claim under these three sections combined cannot exceed Rs 15 lakh in a financial year. Use our simple tax calculator to see how much tax youll pay for the 2021-22 financial year and what your tax return may look like.

Here are the steps to file an income tax return to claim a tax refund from the income tax department. Free easy and accurate. A payment of 999.

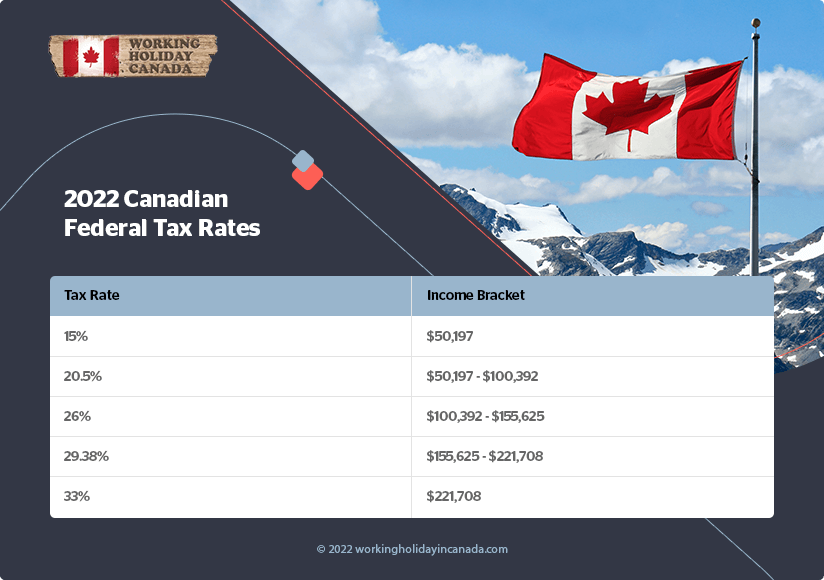

We strive for accuracy but cannot guarantee it. QPIP and EI premiums and the Canada employment amount. 2022 Federal Tax Brackets and Rates.

Tax refund time frames will vary. The federal tax rates in Canada follow the same pattern with rates increasing as your taxable income goes up. The maximum tax refund is 4000 as the property is over 368000.

2022 free Canada income tax calculator to quickly estimate your provincial taxes. This means that only the child can claim the tax refund and the refund will be for 50 of their eligible amount. Its fully guided more cost-effective for you and will guarantee you stay fully compliant with US tax laws.

If youre expecting a tax refund this year heres when you can expect to receive itand some reasons why you may be experiencing a delay. After May 2 English and French hours of operation will be 9 am. Alison Banney Updated Feb 7 2022.

This is a very good service. Get your tax refund up to 5 days early. March 11 2022 at 252 pm I like to track my refund.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022. Fraudulently claiming tax refunds by misreporting income or showing false losses which reduce taxable income can attract heavy penalties. For homes purchased for more than 368000 buyers will receive the full 4000 rebate and pay the remaining LTT balance.

Calculations are based on rates known as of June 17 2022 including federal and provincialterritorial tax changes known at this time. Claims must be submitted within sixty 60 days of your TurboTax filing date no later than May 31 2022 TurboTax Home. This calculator is FREE to use and will give you an instant Australian tax refund estimation.

Calculations are based on rates known as of December 27 2021. CWB 2022 rates are using 2021 rates indexed for inflation. 2021-2022 Tax Brackets Tax Calculator.

Fastest refund possible. Get your tax refund up to 5 days early. Please enter your income.

In the vast majority of cases its best for married couples to file jointly but there may be a few instances when its better to submit separate. Tax refund time frames will vary. 2022 CWB amounts are based on 2021 amounts indexed for inflation.

Fastest tax refund with e-file and direct deposit. Fastest federal tax refund with e-file and direct deposit. Fastest tax refund with e-file and direct deposit.

The IRS issues more than 9 out of 10 refunds in less than 21 days. You must be a Canadian citizen or permanent resident of Canada. 55000 first marginal tax bracket 050 marginal tax rate 275 land transfer tax 250000 upper marginal tax bracket - 55000 lower marginal tax bracket 10 marginal tax rate 1950 land transfer tax 400000 upper marginal tax bracket - 250000 lower marginal tax bracket 15 marginal tax rate 2250 land transfer tax.

Customer service and product. Section 270 of the Income Tax Act was amended in the last budget post demonetisation to ensure that misreporting and under-reporting of income was heavily penalised. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up.

Return within 60 days to Intuit Canada with a dated receipt for a full refund of purchase price. Find out your tax refund or taxes owed plus federal and provincial tax rates. 26 on the next 55233 of taxable income on the portion of taxable income over 100392 up to 155625 and.

After May 2 English and French hours of operation will be 9 am. Originally called the Property Purchase Tax the PPT was first introduced in 1987 as a wealth tax to discourage speculation and cost 1 of the first 200000 and 2 of the remainder although 95 of home purchases did not qualify for the tax at the time as they were below the 200000 mark. Tax-saving investment proofs All the tax-saving investments made by you and the expenditures incurred by you eligible for deduction under section 80C 80CCC and 80CCD1 during FY2019-20 can help you lower your tax liability.

By using Sprintax you will also get the maximum US tax refund. Use our Free Canadian Tax Refund Calculator to calculate your refund. Average tax refund for Canada is 998 - get your Canadian Tax Back Now.

2022 Income Tax Calculator Ontario. For 2022 you pay. Married couples have the option to file jointly or separately on their federal income tax returns.

Ontario land transfer tax. You can now use Sprintax for your US tax return. 15 on the first 50197 of taxable income and.

The Ontario land transfer tax for a home purchased for 500000 in Ottawa is 6475. The IRS issues more than 9 out of 10 refunds in less than 21 days. Tax refund time frames will vary.

The Basics Of Tax In Canada Updated For 2022

How To File Income Tax Return To Get Refund In Canada 2022

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

2022 Tax Day Filing For A Tax Extension Here S How That Works And When Your Taxes Are Due Nbc Chicago

The Basics Of Tax In Canada Updated For 2022

![]()

Canada Income Tax Calculator 2022 With Tax Brackets Investomatica

U S Estate Tax For Canadians Manulife Investment Management

The Basics Of Tax In Canada Updated For 2022

2022 Mileage Calculator Canada Calculate Your Reimbursement

How To File Income Tax Return To Get Refund In Canada 2022

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

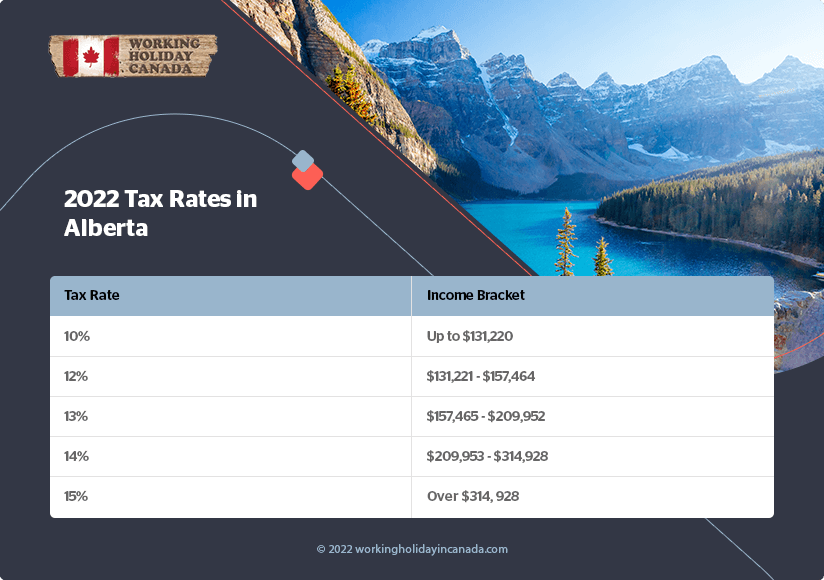

Apply For A Canadian Tax Refund Workingholidayincanada Com

Vintage Yukon Province Northern Canada Snow Alaska Trucker Hat Snapback Baseball Cap Pxq

What Is A Good Rate Of Return On Investments Reverse The Crush In 2022 Investing Investing Money Income Investing

How Income Taxes Work In Canada With Example And Simple Online Tax Calculator Youtube